引言 随着区块链技术的迅猛发展,越来越多的人开始关注如何安全地存储和管理他们的数字资产。在诸多钱包产品中...

Blockchain wallets are digital wallets used to store, send, and receive cryptocurrencies. Unlike traditional wallets that hold physical currency, blockchain wallets manage the keys necessary to access your cryptocurrency funds and execute transactions on the blockchain. With the rise of cryptocurrencies like Bitcoin, Ethereum, and many others, understanding the function and types of blockchain wallets has become essential for anyone looking to participate in the digital economy.

There are several types of blockchain wallets available, each serving a different purpose and offering unique features. The primary categories include hardware wallets, software wallets, and paper wallets.

Hardware wallets are physical devices designed to securely store your private keys offline. They are known for their robust security features and are often considered the safest option for managing cryptocurrencies. Popular examples include the Ledger Nano S, Trezor, and Ledger Nano X. Hardware wallets protect your funds from online threats such as hacking and phishing attacks by keeping the keys securely in a device disconnected from the internet.

Software wallets are applications that run on your computer or mobile device. They can be further classified into three categories: desktop wallets, mobile wallets, and web wallets.

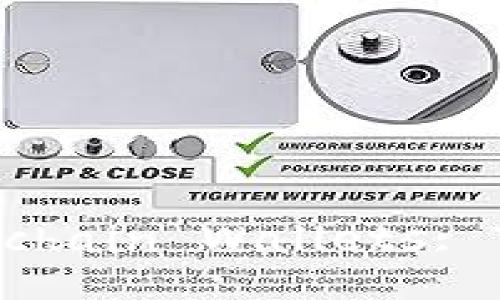

A paper wallet is a physical document containing your public and private keys printed in a QR code format. They are highly secure from online threats, but if the physical paper is lost or damaged, you could lose access to your funds permanently. It is advisable to generate paper wallets using trusted methods to ensure security.

The security of blockchain wallets is paramount due to the irreversible nature of cryptocurrency transactions. Once a transaction is made, it cannot be undone. Therefore, safeguarding your wallet and private keys is essential to prevent unauthorized access and potential loss of funds.

To enhance the security of your blockchain wallet, consider implementing the following best practices:

Losing access to your blockchain wallet can be a distressing experience, especially if your funds are significant. When it comes to non-custodial wallets, the responsibility of access lies entirely with you. Most digital wallets provide a recovery phrase or seed phrase when you set them up, which is a series of words that can be used to restore your wallet. If you happen to lose your wallet or the device on which it is installed, you can use this recovery phrase to regain access to your funds.

For software wallets, if you lose access without a recovery phrase, your chances of retrieving your funds are extremely low. The same applies to hardware wallets. If both the device and the recovery phrase are lost, the assets stored on the wallet will be unrecoverable. Hence, always ensure that you keep backups in multiple secure locations and store your recovery phrases securely.

The safety of a blockchain wallet from potential hacking threats largely depends on the type of wallet you choose. Hardware wallets are typically the safest option because they store your private keys offline and are less vulnerable to remote attacks. Software wallets, particularly web wallets, are more susceptible to hacking due to their internet connectivity, making them targets for phishing attacks and malware infections.

Regardless of the wallet type, always maintain good cybersecurity hygiene. This includes using strong passwords, not sharing your private keys, and being cautious about phishing schemes designed to trick you into revealing sensitive information. Regularly review the security features of your wallet and use those that offer robust protection against unauthorized access.

Yes, it is not uncommon for cryptocurrency users to maintain multiple wallets – one for each type of cryptocurrency or for different purposes. Some wallets are designed specifically for certain types of cryptocurrencies, while multi-currency wallets can manage various assets from a single interface. Using multiple wallets can help you manage your portfolio effectively and enhance security by segmenting your assets.

It’s essential to find wallets that support the specific coins you wish to store and to consider factors such as user experience, security features, and backup options. Keeping a diversified wallet setup may be beneficial for risk management and financial planning.

Most blockchain wallets operate on a fee structure that may include transaction fees and potentially withdrawal fees. Transaction fees are costs charged for processing a currency transaction on the blockchain. They can vary based on network congestion; higher fees may ensure quicker transaction times during peak usage periods.

When using a wallet from third-party services or exchanges, additional fees may apply. It’s advisable to read through the fee structures outlined by your wallet and make comparisons to select the most efficient and cost-effective options for your financial transactions.

When selecting a blockchain wallet, several factors should be taken into account to ensure you make a suitable choice based on your needs:

Choosing the right blockchain wallet is crucial for anyone involved in cryptocurrency transactions. Understanding the different types of wallets, their security features, and best practices for management is key to ensuring the safety of your digital assets. By adhering to security measures, regularly backing up your wallet, and staying informed about emerging threats, you can enjoy a secure cryptocurrency experience. Whether you are a novice or an experienced user, investing time in learning about blockchain wallets can pay off in the security and accessibility of your investments in the long term.